Mastering Gold Trading in the Forex Market 1961322407

Trading gold in the forex market is an exciting venture for both new and seasoned traders. With its unique properties and the influence of various economic factors, gold trading can offer lucrative opportunities when navigated properly. In this article, we will explore the fundamentals of trading gold on forex platforms, including techniques for analysis, risk management, and strategic planning. You can enhance your trading experience with trusted tools and resources like trading gold forex Platform Forex.

Understanding Gold as a Trading Asset

Gold has been a highly regarded financial asset for centuries. As a safe haven commodity, its value tends to rise during times of economic uncertainty. Different factors that drive the price of gold include supply and demand dynamics, geopolitical tensions, inflation rates, and global currency strength, particularly that of the US dollar.

Why Trade Gold in the Forex Market?

Trading gold in the forex market allows traders to take advantage of its price movements against currencies. Gold is typically quoted in USD, making it a prime candidate for forex trading. Traders can speculate on the price of gold versus other currencies, using analysis and trading strategies to gain profits.

Technical and Fundamental Analysis

For successful gold trading, both technical and fundamental analyses are essential.

Technical Analysis

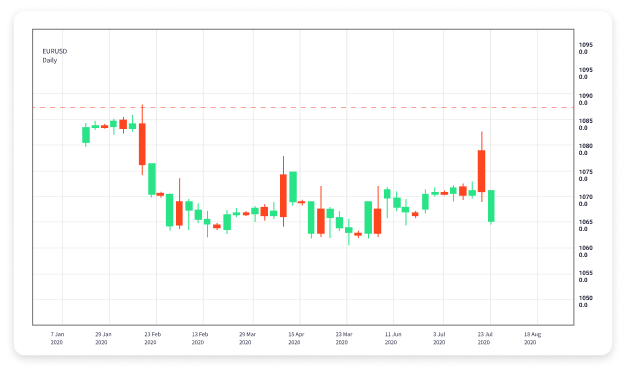

Technical analysis involves studying past market data, primarily price and volume, to project future price movements. Traders utilize charts, indicators, and patterns to make informed decisions. Common technical indicators used in gold trading include:

- Moving Averages: Help identify trends over specific time frames.

- Relative Strength Index (RSI): Measures the speed and change of price movements to identify overbought or oversold conditions.

- Bollinger Bands: Provide insights on price volatility and potential reversal points.

Fundamental Analysis

Fundamental analysis involves analyzing economic indicators and news events to understand what is driving gold prices. Some key indicators include:

- US Dollar Strength: Since gold is dollar-denominated, a weaker dollar usually leads to higher gold prices.

- Interest Rates: Low-interest rates make gold more attractive as an investment compared to interest-bearing assets.

- Inflation Rates: High inflation typically increases demand for gold as a hedge.

Risk Management Strategies

Risk management is crucial when trading gold to mitigate potential losses. Here are some effective strategies:

- Set Stop-Loss Orders: Establishing predetermined exit points helps protect against larger losses.

- Diversify Your Portfolio: Including different asset classes can reduce risk.

- Use Proper Position Sizing: Determine how much of your capital to risk on each trade based on your overall trading strategy.

Choosing the Right Forex Broker for Gold Trading

Your choice of forex broker significantly impacts your trading experience. Here are some criteria to consider when selecting a broker for trading gold:

- Regulation: Ensure the broker is regulated by trustworthy financial authorities.

- Trading Platform: A user-friendly and reliable trading platform can enhance your trading performance.

- Spreads and Commissions: Look for competitive spreads and lower commission rates for trading gold.

Developing a Trading Strategy

Having a well-thought-out trading strategy is essential for success. Here is a simplified approach to developing your trading strategy:

- Define Your Goals: Clarify what you want to achieve with your trading and set realistic targets.

- Analyze Market Trends: Use both technical and fundamental analyses to identify trading opportunities.

- Implement Risk Management: Always include strategies to minimize loss potential.

- Review and Adjust: Regularly assess your trading strategy and make necessary adjustments based on performance and market changes.

Keeping Up with Market News

Being informed about current events and economic news is vital for gold traders. Staying updated can help anticipate potential market movements. Sources of information include financial news websites, economic calendars, and analytical tools provided by brokers.

Conclusion

Trading gold in the forex market can be a rewarding pursuit if approached with the right strategies and mindset. By understanding market dynamics, employing effective analyses, managing risks, and continually educating yourself, you can position yourself for success. Always remember that trading involves risks, and it’s essential to trade responsibly.

Leave a Reply

Want to join the discussion?Feel free to contribute!